Amidst growing investor expectations for high-quality climate-related financial disclosures, organizations are increasingly turning to the TCFD for guidance. But lingering confusion remains about what the TCFD entails, including its recommendations and their underlying benefits. Aligning with the TCFD framework can be especially challenging in the absence of comprehensive ESG data management systems. Luckily, TCFD reporting tools have proven to be invaluable in facilitating this process.

In this post, we’ll provide an overview of the TCFD, including its core recommendations, disclosure principles, and why it’s an important framework to adopt. We’ll also explore TCFD reporting tools and how they can help simplify the complex journey of producing decision-useful climate-related disclosures.

What is the Task Force on Climate-Related Financial Disclosures (TCFD)?

Historical snapshot

In the wake of COP21 and the Paris Agreement, the Financial Stability Board (FSB) established the Task Force on Climate-related Financial Disclosures (TCFD) in 2015.

Chaired by Michael R. Bloomberg, the industry-led group set out to develop recommendations for enhanced climate-related disclosures that could promote more informed investment, credit, and insurance underwriting decisions. In turn, this would enable stakeholders to better understand the financial system’s exposures to climate-related risks. The TCFD published its first recommendations (the “TCFD Framework”) in 2017, followed by an updated version in 2021.

The TCFD also helps companies disclose their climate impacts in the transition to a low-carbon economy, and to do so with greater consistency and comparability. Consequently, this facilitates the integration of climate-related risks and opportunities into risk management, strategic planning, and decision-making processes; better for the company’s bottom line—and the planet. Indeed, the TCFD recommendations forward this dual approach through the embedded principle of double materiality—the impact that a company has on the climate, and the impact that physical and transition climate risks pose on the company.

Naturally, this has significant implications for the future of sustainable finance, defined as the consideration of the environmental, social, and governance (ESG) factors of a project or economic activity in investment decisions. According to Deloitte, “as both companies and investors increase their understanding of the financial implications of climate change, markets will be better able to channel investment to sustainable and resilient solutions, opportunities, and business models.”

Through widespread adoption of the TCFD, the TSB aims for more efficient capital allocation, and greater transparency in pricing climate-related risk, on a global scale.

TCFD reporting: the current state

As of November 2022, more than 4000 companies and organizations in 101 jurisdictions supported the TCFD, with a combined market capitalization of USD 27 trillion. While the TCFD recommendations remain voluntary in many jurisdictions, they’re becoming more regularly used to frame and inform ESG policy and regulation worldwide. And, in some jurisdictions, they’re soon to become mandatory.

Several countries, including New Zealand, the UK, and Switzerland, along with regulators such as the US Securities and Exchange Commission and Canadian provincial securities commissions, are issuing regulations to mandate the application of the TCFD recommendations. Furthermore, initiatives focused on developing corporate sustainability reporting standards, such as ISSB and EFRAG, have fully incorporated them into their draft climate disclosure standards.

Notwithstanding this growing momentum, the FSB calls for more urgent progress. Their multi-year assessment of 1400 large global companies found that only a very small minority (4%) implemented all eleven recommendations in fiscal year 2021, while the vast majority (80%) disclosed in line with at least one. In the Canadian context, a 2023 PwC analysis of Canada’s top 250 publicly-traded companies reveals that 77% of them have yet to disclose a TCFD report, “leaving them potentially unprepared for mandatory reporting requirements underpinned by the TCFD framework”.

Certainly, producing high-quality, decision-useful climate disclosures isn’t a straightforward process. On the one hand, organizations often struggle to secure relevant and robust data, engage with stakeholders, report on climate-related risk management processes, and ensure adequate leadership support.

On the other, there is a tangible lack of understanding of what the TCFD reporting framework actually entails, including the specific recommendations and disclosure principles stipulated by the FSB. Let’s turn to these now.

TCFD reporting framework: A closer look

The TCFD is an ESG framework for organizations to develop more effective climate-related financial disclosures through their existing reporting processes. Moreover, it aims to ameliorate investors’ capacity to assess—and appropriately price—climate-related opportunities and risks.

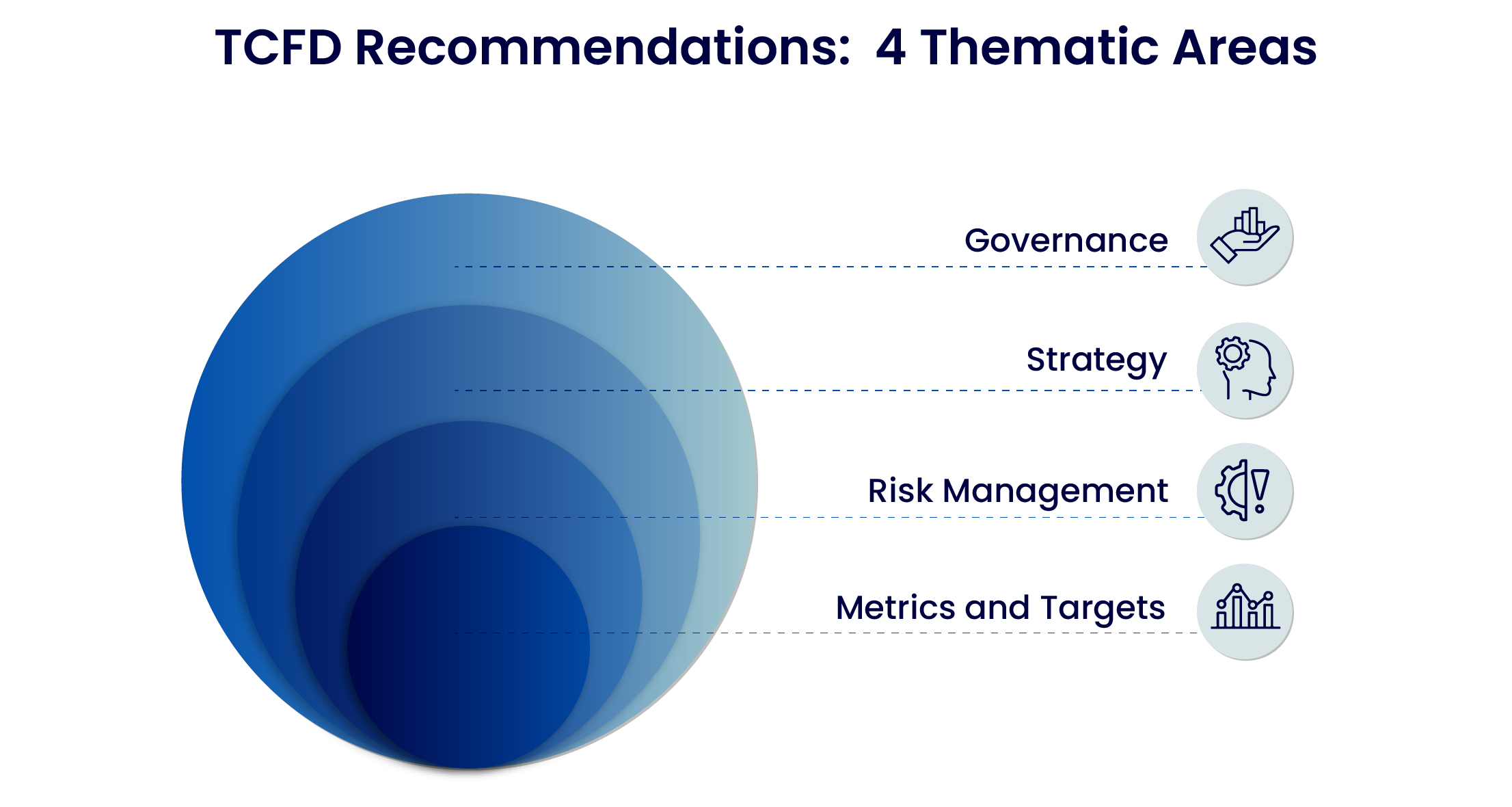

The TCFD framework outlines eleven recommendations, which are referred to as key climate-related financial disclosures or recommended disclosures. The recommendations are structured around four thematic areas representing core elements of organizations' operations: governance, strategy, risk management, and metrics and targets.

- Governance: how the organization governs around climate-related opportunities and risks, including board oversight and managerial responsibilities for evaluating and managing them.

- Strategy: short, medium, and long-term climate-related risks and opportunities and their impact on an organization's businesses, strategy, and financial planning; these include disclosing both physical and transition risks.

- Risk management: the processes organizations use to identify, assess, and manage climate-related risks. The TCFD recommends that the latter are also carefully integrated into overall risk management processes.

- Metrics & targets: used to assess and manage material climate-related risks and opportunities, including Scope 1 and Scope 2 greenhouse gas (GHG) emissions, and, if appropriate, Scope 3.

Source: “Final Report: Recommendations of the Task Force on Climate-related Financial Disclosures,” TCFD, June 2017

Organizations are encouraged to adopt a forward-looking perspective in assessing climate-related risks. Moreover, while enhancing transparency and promoting informed decision-making, the TCFD recommendations are also complementary to other popular reporting schemes such as the CPD and GRI.

Key disclosure principles

To support its recommendations and guide the development of climate-related financial reporting, the Task Force has set forth specific disclosure principles. These principles support the production of high-quality and decision-useful disclosures that facilitate a better understanding of how climate change impacts organizations. They also align with other internationally established frameworks for financial reporting.

TCFD disclosure principles:

- Disclosures should present pertinent information.

- Disclosures should be specific and complete.

- Disclosures must be clear, balanced, and easy to comprehend.

- Disclosures should be consistent over time.

- Disclosures should be comparable among companies operating within the same sector, industry, or portfolio

- Disclosures should be reliable, verifiable, and based on objective criteria.

- Disclosures should be provided promptly.

Why is TCFD reporting important?

While committing to the TCFD framework involves significant cross-functional effort, it can support growth and unlock new value. Let's explore why they’re important for organizations across sectors and industries:

- Enhanced risk management: TCFD reporting helps organizations pinpoint—and subsequently assess—particular climate-related risks with greater effectiveness. For one, proactively addressing these risks entails developing appropriate mitigation strategies. Consequently, organizations can enhance their resilience, protect their assets, and seize opportunities in the transition to a low-carbon economy.

- Improved investor confidence: when investors are provided with comprehensive and standardized climate-related information, they can more accurately evaluate organizations' sustainability performance and risk exposure. Consequently, enhanced transparency and clarity in climate disclosures can foster investor confidence, attracting new capital from investors who prioritize ESG factors in their investment decisions.

- Access to capital: as sustainable finance gains momentum, TCFD reporting has become increasingly important for accessing capital. Many investors and financial institutions are integrating climate-related risks and opportunities into their investment and lending decisions. By implementing TCFD reporting practices, organizations can align themselves with these expectations and enhance their chances of securing capital.

- Operational efficiency: TCFD reporting encourages organizations to assess their energy use, carbon emissions, and resource consumption. By identifying inefficiencies and implementing measures to reduce their environmental footprint, organizations can enhance operational efficiency, cut costs, and advance a more sustainable business model.

- Long-term strategic planning: factoring in climate-related risks and opportunities in strategic planning allows organizations to anticipate market trends, adapt to regulatory changes, and capitalize on emerging opportunities associated with the transition to a low-carbon and climate-resilient economy.

In summary, TCFD reporting aids organizations in addressing climate change, enhancing risk management, efficiency, and attracting responsible investments. While understanding TCFD recommendations and disclosure principles requires time and effort, it’s an important first step toward more impactful disclosures.

Armed with a better understanding of the TCFD framework, let’s explore how reporting tools can facilitate the adoption of the eleven recommendations.

TCFD reporting tools 101

While the adoption of the TCFD has become more widespread, so has the use of TCFD reporting tools to facilitate the difficult process of gathering, analyzing, and reporting complex, decision-useful data. But what do these tools have to offer, and how they can simplify climate-related disclosures?

In what follows, we’ll review some of the key features and functionalities of TCFD reporting tools, as well as their benefits:

- Streamlined data collection and management: simplifying the collection of climate-related data from various sources within an organization is a critical step. TCFD reporting tools automate the processby integrating with various systems and data sources, such as sustainability databases, financial systems, and climate models; this information gets stored in a secure repository to maintain its quality and integrity. Look out for specific features such as data validation and quality checks, important for ensuring accuracy and precision.

- Benefits: by streamlining data collection, organizations can focus on data analysis and interpretation—and their overarching ESG strategy—rather than spend excessive time and resources on manual processes. Moreover, TCFD reporting tools improve the quality, accuracy, and consistency of climate-related data. Room for human error is greatly reduced and centralizing the data helps build a secure system of record.

- Data visualization and reporting: effective communication of climate-related information is crucial for engaging stakeholders and fostering transparency. TCFD reporting tools should include intuitive data visualization and reporting functionalities that allow organizations to present their climate-related data in clear and understandable formats. Look out for interactive dashboards, charts, and reports that visually represent climate-related risks, opportunities, and actions.

- Benefits: by effectively presenting climate-related risks, opportunities, and actions, reporting tools help organizations build trust and credibility with investors, customers, employees, and regulators. Enhanced stakeholder engagement can lead to improved relationships, increased investor confidence, and potential access to new sources of capital for sustainable initiatives.

- Embedded TCFD reporting framework: dedicated TCFD reporting tools align with TCFD recommendations and reporting frameworks. They provide embedded, structured templates and guidelines based on TCFD recommendations, helping organizations report information that is both relevant and comparable.

- Benefits: organizations can ensure compliance with TCFD requirements and avoid potential penalties or reputational risks associated with non-compliance. Furthermore, reporting tools can integrate with other reporting frameworks, such as sustainability reporting standards, providing a cohesive approach to reporting climate-related information.

- Integration with existing reporting frameworks: many organizations already adhere to existing reporting frameworks, such as sustainability reporting standards or financial reporting requirements. Reporting tools designed for TCFD compliance can integrate with these existing frameworks, ensuring that climate-related disclosures align with other reporting requirements.

- Benefits: integration ensures that climate-related disclosures are aligned with other reporting obligations, reducing the duplication of efforts and streamlining the reporting process. It allows organizations to leverage their existing reporting infrastructure and avoid the need for separate reporting mechanisms for climate-related information. By integrating with existing frameworks, reporting tools also provide a comprehensive view of an organization's overall performance, risks, and opportunities.

In summary, TCFD reporting tools improve standardization and consistency to ensure that climate-related disclosures are uniform and comparable over time and across businesses. This standardization ultimately benefits investors and stakeholders by providing them with reliable data for decision-making and benchmarking organizational performance.

Now that we know more about what TCFD reporting tools can offer, let’s explore the common question: “How do I know which one is best for my organization?”

TCFD reporting tools: How do I select the right one?

Choosing the right TCFD reporting tool is a crucial decision for organizations aiming to enhance climate transparency and comply with TCFD recommendations.

Nonetheless, this instigates two perennial—albeit common—questions: how do I know which ESG data management and reporting solution is a good fit for my organization? And, how do I even go about navigating the sea of vendors currently on the market?

As you embark on your search, consider the following factors:

- Identify specific reporting needs: determine your organization's specific reporting needs based on its size, industry and reporting obligations. For example, consider the type and complexity of climate-related data you need to collect and analyze, as well as the reporting formats and templates that align with your stakeholders’ expectations.

- Scope and features: assess the scope and features offered by the reporting tool. Consider whether it covers all aspects of TCFD reporting, including data collection, peer benchmarking, and reporting functionalities. Ensure that the tool aligns with your organization's specific reporting requirements and provides the necessary capabilities to comply with TCFD recommendations.

- “I” is for integration: evaluate the tool's integration capabilities with your existing systems and reporting frameworks. Consider whether the tool can seamlessly integrate with your data management systems, financial reporting platforms, and other relevant software. Integration ensures efficient data flow and reduces duplication of efforts, allowing you to leverage your existing infrastructure for TCFD reporting.

- Ease of use: consider the platform’s degree of user-friendliness. Assess its interface, usability, and customization options. A well-designed system will simplify the reporting process, reduce training time for users, and enhance overall efficiency. Look for platforms that offer intuitive dashboards, clear data visualization, and customizable reporting templates.

- Data security and privacy: ensure the reporting platform provides robust data security measures. Evaluate its data encryption protocols, access controls, and compliance with relevant data protection regulations. Consider its ability to handle sensitive climate-related data securely, particularly if you're working with confidential information.

- Scalability and adaptability: comprehensive reporting platforms are designed to accommodate organizations of varying sizes and industries, which means they can be scaled to meet the specific needs and reporting requirements of each organization. Additionally, they need to constantly evolve and update themselves to keep pace with changing regulations and emerging best practices, ensuring continued compliance and adaptability in an evolving landscape.

- Seek demonstrated TCFD expertise: look for reporting tools that have a proven track record and expertise in TCFD compliance. Evaluate whether the tool's developers have a deep understanding of TCFD recommendations, climate-related reporting frameworks, and industry-specific challenges. A tool designed specifically for TCFD reporting is more likely to meet your organization's needs effectively.

- Consider support and training: evaluate the level of customer support and training provided by the vendor. Look for resources such as training materials, user guides, and responsive customer support channels. Adequate support and training ensure that your organization can effectively utilize the TCFD reporting tool, troubleshoot issues, and maximize its benefits.

In addition to the above, it’s important to request demos and trial periods from the prospective vendors. This allows you to assess the tool’s functionalities, user experience, and suitability for your organization's requirements. Furthermore, consider involving key stakeholders from different departments—sustainability teams, finance professionals, and IT experts—to ensure a comprehensive evaluation. By gathering diverse perspectives, you can also garner additional support and buy-in.

Additionally, it could be beneficial to reach out to peers and industry experts for recommendations and insights. Understanding their experiences with different TCFD reporting tools can provide valuable guidance and help you make an informed decision. Consider consulting the TCFD Knowledge Hub for helpful guidance on implementing the framework, as well as CDSB’s “TCFD Good Practice Handbook”.

Next, we’re going to review some common implementation issues and propose tips for how to overcome them.

Tips for successful implementation

Implementing TCFD reporting tools is a critical step in enhancing climate transparency and complying with TCFD recommendations. However, successful implementation requires careful planning, coordination, and addressing potential challenges, which commonly include:

- Limited data availability and quality

- Technical roadblocks with integration

- Effective stakeholder engagement

- Keeping pace with evolving TCFD requirements

To mitigate these and other recurrent challenges, consider the following strategies:

- Establish clear objectives: clearly define your organization's objectives for implementing TCFD reporting tools. Identify the specific goals you aim to achieve, such as enhancing climate-related risk management, improving investor communication, or aligning with sustainability frameworks. Clear objectives will guide your implementation strategy and help you measure the success of the tool. Communicate these objectives to the vendor and have them guide you.

- Regularly engage stakeholders: involve key stakeholders from different departments, such as sustainability, finance, risk management, and IT. Collaborate with these stakeholders to gather diverse perspectives, ensure buy-in, and align the tool's functionalities with their respective needs. Establish a cross-functional team to oversee the implementation, ensuring effective communication and coordination.

- Data quality and management: pay close attention to data quality and management throughout the implementation process. Define data governance frameworks, establish data collection protocols, and take steps to ensure data accuracy, consistency, and integrity. Conduct regular data audits and validation checks to maintain the reliability of climate-related information.

- Training and capacity building: provide comprehensive training and capacity-building programs to users and stakeholders involved in the TCFD reporting process. Ensure that they have a thorough understanding of TCFD recommendations, the reporting tool's functionalities, and the overall reporting framework. Invest in ongoing training and support to keep users up to date with the latest features and industry best practices.

- Internal communication and change management: implementing TCFD reporting tools may require changes in workflows, processes, and organizational culture. Effective internal communication is essential to ensure all stakeholders are aware of the changes and understand their roles and responsibilities. Develop change management strategies to address any resistance, promote adoption, and foster a culture of climate transparency and collaboration.

By proactively addressing challenges, organizations can successfully implement TCFD reporting tools and enhance their climate-related financial disclosures. Ultimately, the implementation process is an opportunity to embed climate transparency into your organization's DNA.

Driving climate transparency with Novisto

Implementing TCFD reporting tools is a crucial step for organizations seeking to enhance climate transparency and comply with TCFD recommendations. By following best practices such as engaging with stakeholders, prioritizing data quality, and providing training, organizations can successfully leverage these tools to streamline their climate-related financial disclosures and make informed decisions.

Choosing the right software provider requires careful evaluation and consideration of factors such as scope and features, integration capabilities, ease of use, data security, and scalability. By selecting a platform that aligns with your organization's needs and requirements, you can effectively gather, analyze, and report climate-related information that will satisfy your investors and other key stakeholders.

To explore a solution for your TCFD reporting needs, we recommend booking a demo with Novisto. The platform provides comprehensive guidance and recommendations, including data collection for specific climate-related performance measures aligned with the TCFD framework. With Novisto, you can streamline your TCFD reporting process, enhance data accuracy and consistency, and effectively communicate your climate-related risks, opportunities, and progress.

Get started on unlocking the power of climate transparency in your financial disclosures.

Request a demo today.