In today’s corporate world, the paradigm shift to sustainability and sustainable business practices is quickly gaining ground. Stakeholders including investors, bankers, large customers, and consumers are looking for ESG data and information to make their investing, lending, and purchasing decisions. This shift is fueling a demand for ESG data—information on companies’ environmental, social, and governance practices—that is comparable, reliable, and widely accessible.

But how are companies actually disclosing this data? And, given the multitude of ESG reporting frameworks and standards in existence, how can organizations best manage their data to ensure it meets stakeholder needs and expectations of quality?

Below is a comprehensive guide to corporate sustainability reporting, including the different types of reporting, key organizations, ESG standards, and ESG frameworks in the space.

About corporate sustainability

Corporate sustainability relates to a strategy whereby a business delivers its goods and services in a manner that is both profitable for itself and responsible towards the environment and society, both in its use of natural, human, and social capital and in its impacts on them.

The concept of corporate sustainability is evolving to become a critical component of companies’ strategies, operations, and reporting, and increasingly considers a wide array of environmental, social, and governance (ESG) issues. Although ESG and sustainability are not the same, they are often used interchangeably when we talk about sustainability (or ESG) reporting. In this blog post, we will use “sustainability reporting” and “ESG reporting” synonymously to describe the disclosure of information about a company’s approach to environmental (E), social (S), and governance (G) issues.

About corporate sustainability reporting

The business issues that fall under the ESG categories are not new. If they are material to the conduct of business, companies must manage them diligently. For manufacturing companies it may be health and safety, for software companies it may be customer privacy, and for food and beverage makers it may be product ingredients. What is new is the explicit focus of investors, customers, bankers, employees, and other stakeholders on how companies are managing these issues, and how they're making their decisions.

By the same token, corporate sustainability reporting isn’t new. In the past, it was limited to a communications exercise in response to environmental liability and public regulations. It was neither mandatory nor standardized. Since the early 2000s, sustainability reporting shifted to more of an exercise for enhancing corporate citizenship and reputational capital. During this time, an increasing number of voluntary ESG reporting frameworks and standards became available to use; while this increased the amount of information in the market, it also created a lot of noise and poor-quality information.

Today, the exponential rise in demand for decision-useful ESG and sustainability information is shifting corporate sustainability reporting in the direction of a standardized and increasingly mandatory exercise.

Why report on ESG?

There are several reasons for companies to report on their sustainability, or ESG, performance and issues. Each is a powerful driver in its own right, and when acting in combination, they effectively compel companies to improve their sustainability reporting practices—or to start to report, when they haven’t already:

•Market drivers. Investors, customers, bankers, insurers, and other stakeholders and capital providers are increasingly recognizing that a company’s financial performance, risk profile, and longevity are inextricably tied to the proper management of its sustainability-related issues. As such, they’re increasingly looking to understand, via data and narrative disclosures, how a company is performing on various sustainability and ESG issues. In turn, this information influences the decisions they make–decisions that directly affect the company’s business activities. To meet the information demands of these stakeholders, companies need to produce comparable, reliable, and timely disclosures.

•Regulatory drivers. Governments around the world are increasingly adopting policies to promote sustainability; they’re also increasingly mandating corporate disclosures of sustainability, ESG, and climate-related data. For example, in the European context, the Corporate Sustainability Reporting Directive (CSRD), which targets public and private companies, both large and small, entered into force on January 5 2023. In the U.S., the Securities and Exchange Commission (SEC) recently issued proposed new climate disclosure regulations for all US listed companies, which are supposed to come into effect in 2024. To disclose such information, companies will need to collect and report high-quality, auditable data—in the same way that they collect and report financial data.

•Value creation. By measuring and managing its material ESG issues, a company can increase its growth prospects, and reduce its operating expenses and risk profile, all of which improves its financial performance and thus creates financial value. By providing clear, consistent, decision-useful information to capital markets on how it manages these issues, companies can ensure that markets reflect their improved performance by lowering the company’s risk profile and granting a higher market value—and therefore, a higher enterprise value.

Expanding value creation to the environment and society

When companies expand their focus to manage not only how ESG or sustainability-related issues affect their business, but how their business affects the sustainability dimensions of environment and society, they measure and manage their social, environmental, and economic impacts. By adopting responsible and regenerative practices throughout its value chain (think upstream suppliers and downstream customers and communities), a company can effectively reduce its negative impacts and increase their positive ones, creating value for society by increasing the value of natural, human, and social capital.

The corporate ESG reporting landscape

The growing demand for better measurement and reporting of ESG and sustainability-related information has given rise to a body of regulations, standards, and frameworks. In turn, these provide a structure relevant to companies’ governance, future planning, and use of resources.

Before we dive into the individual ESG reporting frameworks and standards, it’s important to understand the difference between the two, as defined here by the Global Reporting Initiative:

- A standard is a specific quality requirement for reporting. It contains detailed criteria, or ESG metrics, of “what” should be reported on a specific topic. Standards involve a public interest focus, independence, due process, and public consultation, strengthening the basis of what is being asked.

- A framework is a broader, contextual “frame” for information. It is a set of principles providing guidance and shaping understanding of a certain topic, defining the direction of information but not the methodology of collection or reporting itself. It may be used when a well-defined standard does not exist.

Another important distinction pertains to the data or information itself: whether it comes directly from the companies or is produced by third parties. ESG ratings are an example of the latter. They are created by research firms based on proprietary methodologies; while they may include company data and disclosures in the process of assessing a company’s environmental, social, and governance practices, their resulting scores constitute a distinct type of ESG data. While market participants use this data in capital allocation decisions, ESG ratings and scores do not replace the need for comparable, reliable, and timely corporate ESG data disclosures.

List of Key Organizations: ESG reporting standards

EFRAG Sustainability Reporting Board

The European Financial Reporting Advisory Group (EFRAG) was established in 2001 by the European Commission. The group has two pillars—one focused on financial reporting and the other on sustainability reporting. In its financial reporting activities, EFRAG ensures that the European view is represented in the International Accounting Standards Board’s (IASB) standard-setting process and provides advice to the European Commission on the International Financial Reporting Standards (IFRS).

Since being mandated by the European Commission to develop European Sustainability Reporting Standards (ESRS) as part of the Commission's 2021 Corporate Sustainability Reporting Directive (CSRD) proposal, EFRAG modified its governance structure to create the EFRAG Sustainability Reporting Board, which sits alongside the EFRAG Financial Reporting Board and is divided into three chapters (European Stakeholders, National Organizations, and Civil Society Organizations). The Sustainability Reporting Board is responsible for all sustainability reporting positions of EFRAG and oversees and authorizes EFRAG’s draft and final sustainability reporting due process documents.

In March 2022, EFRAG released working papers, or draft sustainability reporting standards. The first set of finalized standards was adopted in July 2023. In 2024, two additional standards are expected to be published: sector-specific standards, and standards for non-listed small and medium enterprises (SMEs). These standards are expected to be transposed into national law by the 27 countries in Europe. France was the first country to transpose the CSRD into national law as of December 7, 2023.

Global Reporting Initiative (GRI)

The Global Reporting Initiative (GRI) is an independent, international, and non-governmental organization created in 1997 that helps businesses and other organizations take responsibility for their impacts by providing them with a global common language to communicate those impacts. Its goal is to empower disclosures and decisions that are accountable, identify and manage risks, and capitalize on opportunities while creating social, environmental, and economic benefits for all.

The GRI provides standards for sustainability reporting called the GRI Standards. First published in 2010, they are the first and most widely adopted standards for sustainability disclosure. They are divided into Universal Standards that apply to all companies, Sector Standards applicable to companies in specific industries, and Topic Standards that apply to companies depending on their material impacts. In October 2021, the GRI significantly revised its Universal Standards and released its first Sector Standard for Oil and Gas. In January 2024, sector standards for Coal, Agriculture, Aquaculture, and Fishing Sectors came into effect (with 38 additional ones expected in the coming years).

GRI also entered into collaborative agreements with EFRAG to draft the ESRS, and with the ISSB to draft the IFRS Sustainability Disclosure Standards (SDS).

International Sustainability Standards Board (ISSB)

The ISSB was established in November 2021 by the IFRS Foundation Trustees to work alongside the International Accounting Standards Board (IASB) to develop the IFRS SDS. Established in 2001, the IFRS is a not-for-profit organization dedicated to developing a single set of global accounting (and now sustainability) disclosure standards to bring transparency and accountability to financial markets.

The IFRS Foundation has consolidated into the ISSB’s Climate Disclosure Standards Board (CDSB). In August 2022, it also consolidated the Value Reporting Foundation (VRF), which comprises the Sustainability Accounting Standards Board (SASB) and the International Integrated Reporting Council (IIRC).

In March 2022, the ISSB launched consultations on two proposed standards—one on general sustainability-related disclosure requirements and one on climate-related disclosure requirements. Final versions are expected by the end of 2022. These prototypes are the result of six months of work by the CDSB, IASB, TCFD, VRF and the World Economic Forum (WEF) and are supported by the International Organization of Securities Commissions (IOSCO). The IFRS Foundation has also signed a collaboration agreement with the GRI to coordinate their standard-setting activities.

In August 2023, the IFRS Foundation and EFRAG released an interoperability mapping intended to showcase the relationship between ESRS and ISSB S1 and S2 standards.

Sustainability Accounting Standards Board (SASB)

SASB is an independent, not-for-profit organization established in 2011 to set standards for companies to disclose sustainability or ESG information to investors and other providers of financial capital. Since its inception, SASB’s goal has been to establish industry-specific disclosure standards, called the SASB Standards, across environmental, social, and governance topics that facilitate communication between companies and investors about financially material, decision-useful information.

In 2021, SASB and the IIRC merged into the new VRF. As of August 2022, the VRF merged into the IFRS Foundation as part of the ISSB, which has created a global set of baseline corporate sustainability disclosure standards. The ISSB intends to leverage the industry-specific standards and standard-setting process developed by SASB in creating its standards.

SASB Standards were developed for 77 industries, each of which includes disclosure topics and performance metrics for the sustainability risks and opportunities “reasonably likely to materially affect the financial condition, operating performance, or risk profile of a typical company within an industry” (i.e., material impacts on a company’s enterprise value). SASB Standards include disclosure topics and metrics across five dimensions of sustainability: Environment, Social Capital, Human Capital, Business Model and Innovation, and Leadership and Governance.

List of Key Organizations: ESG Reporting Standards

Corporate Sustainability Reporting Directive (CSRD)

The CSRD is the new European Union regulatory directive created to strengthen corporate sustainability disclosures. It amended the Non-Financial Reporting Directive (NFRD) and has been in effect since January 5, 2023. The CSRD aims to significantly increase corporate sustainability disclosures to meet users’ needs for comparable, relevant, and reliable information.

Materiality and the CSRD

At the heart of the CSRD lies the notion or concept of double materiality, which entails adopting both an outside-in and inside-out perspective—which corresponds to the terms “financial materiality” and “impact materiality” respectively. They can be distinguished in the following manner:

- Financial materiality concerns the influence of ESG issues on the company's operations, financial performance, risk profile, and similar factors.

- Impact materiality focuses on the company's external effects, encompassing both positive and negative impacts on people, the planet, and society.

By embracing the concept of double materiality, the CSRD aims to promote a more balanced and comprehensive sustainability reporting culture within organizations.

Who is in scope?

All large companies and all publicly listed companies (except microenterprises) will be in the scope of the CSRD. This means nearly 50,000 EU companies will have to report sustainability information compared to ~11,600 companies under the existing regulation. However, publicly listed small and medium enterprises (SMEs) will be exempted from the application of the directive until 2028.

For additional details on the size and scope of companies applicable, please refer to the CSRD Fact Sheet.

SEC Climate Regulations

In March 2022, the U.S. Securities and Exchange Commission (SEC) proposed rule changes that will require publicly traded companies in the U.S. to disclose annually how their business is assessing and managing climate-related risks. This includes providing information about their greenhouse gas (GHG) emissions and transition plans, in addition to climate-related risks that are “reasonably likely to have a material impact on [their] business, results of operations, or financial condition.” Furthermore, the primary objective of the regulation is to enhance and standardize climate-related disclosures to address investors’ need for this information in making their capital allocation decisions.

Expected to be finalized last fall, the final SEC climate disclosure rule is now anticipated for Spring 2024.

For additional details, please refer to the SEC Fact Sheet.

List of Key Organizations: ESG Reporting Frameworks

Climate Disclosure Standards Board (CDSB—initiative of CDP)

The Climate Disclosure Standards Board (CDSB) was an international not-for-profit consortium of business and environmental not-for-profit organizations created in 2007. Its goal was to advance and align the global mainstream corporate reporting model and equate the relevance of information about business’s use of and effect on natural capital with the relevance of information about financial capital to better understand holistic corporate performance.

To this end, it created the CDSB Framework. Ultimately, it aimed to standardize reporting on environmental information through collaboration, and by identifying and coalescing around the most widely shared and tested reporting approaches that were emerging around the world. On January 31, 2022, the organization was merged into the IFRS Foundation as part of the ISSB, which is in the process of creating a global set of baseline corporate sustainability disclosure standards. These will be informed, at least in part, by the CDSB framework and approach.

International Integrated Reporting Council (IIRC)

The IIRC is a global coalition of regulators, investors, companies, standard setters, the accounting profession, academia, and not-for-profits created in 2010 to promote integrated thinking and integrated reporting principles. They believe that communication about value creation, preservation, or erosion is the next step in the evolution of corporate reporting.

The Council produced the Integrated Reporting Framework on this basis. In 2021, the IIRC merged with SASB to become the VRF. In August 2022, the VRF merged into the IFRS Foundation as part of the ISSB, which has created a global set of baseline corporate sustainability disclosure standards. The ISSB has leveraged the Integrated Reporting Framework developed by the IIRC in creating its standards.

Task Force on Climate-Related Financial Disclosures (TCFD)

The Financial Stability Board established the Task Force on Climate-related Financial Disclosures (TCFD) in 2015 in the wake of COP21 and the Paris Agreement to develop recommendations for more effective climate-related disclosures that could promote more informed investment, credit, and insurance underwriting decisions. In turn, this would enable stakeholders to better understand the concentrations of carbon-related assets in the financial sector and the financial system’s exposures to climate-related risks.

In 2017, the TCFD published its recommendations on climate-related financial disclosures, known as the TCFD Framework. The recommendations are structured around four thematic areas that represent core elements of how organizations operate: governance, strategy, risk management, and metrics and targets. They also embed the principle of double materiality—considering both the impact that a company has on climate through its emissions and the impact that the physical and transition risks of climate change has on the company.

In October 2021, the TCFD updated its recommendations and provided new guidance on metrics, targets, and transition plans, and the framework has informed the development of the IFRS Sustainability Reporting Standards developed by the ISSB.

To date, more than 3,000 organizations and companies support TCFD with a combined market capitalization of $27.2 trillion. Several countries (New Zealand, the UK, Switzerland) and regulators (the US Securities and Exchange Commission and Canadian provincial securities commissions) are issuing regulations to mandate the application of the TCFD Recommendations. In addition, both initiatives to develop corporate sustainability reporting standards (see ISSB and EFRAG above) have completely integrated the TCFD Recommendations into their draft climate disclosure standards.

As of October 12, 2023, the TCFD has fulfilled its remit and disbanded. The IFRS Foundation will take over the monitoring of the progress of companies’ climate-related disclosures in 2024.

Key Organizations: ESG Research and Ratings

Carbon Disclosure Project (CDP)

The CDP (which was formerly known as the Carbon Disclosure Project until the end of 2012) is a not-for-profit organization that aims to study the implications of climate change for the world’s principal publicly traded companies. It runs a global disclosure platform for investors, companies, cities, states, and regions to manage their environmental impacts by helping persuade companies throughout the world to measure, manage, disclose, and ultimately reduce their greenhouse gas (GHG) emissions.

The CDP also publishes annual ratings known as CDP Scores which rate companies and cities on their sustainability performance. The scoring system measures the comprehensiveness of disclosure, awareness of environmental risks, and best practices associated with environmental leadership (such as setting ambitious and meaningful targets) across three categories: climate change, forests, and water security. For each category, the CDP discloses questionnaires, scoring criteria and methodologies, and results publicly on its website.

By 2025, CDP aims to expand its scope to cover the full range of planetary boundaries and earth systems including: land, resilience, biodiversity, waste, oceans, freshwater, and food. It will adopt a wider, more holistic approach to disclosing, analyzing, and improving environmental data with a focus not only on human demands on the environment but also on increasing the supply of natural systems. The approach will diversify the disclosure levers of market and regulatory actors.

MSCI

MSCI is an investment research firm providing research, analytics tools, investment indexes across industries, as well as ESG and climate products. Its mission is to provide transparent information on key drivers of risk and return to investors and other market participants to enable better investment decisions.

In its sustainability and ESG activities, MSCI provides several tools and analyses such as ESG and climate indexes, ESG fund rating, and MSCI ESG Ratings of companies that are meant to assess a company’s resilience to long-term industry material ESG risks. The approach is designed to provide institutional investors with insights and ESG integration tools to support long-term value creation. MSCI’s rankings are based on publicly available information such as government, not-for-profit and regulatory datasets, company disclosure documents, and media sources.

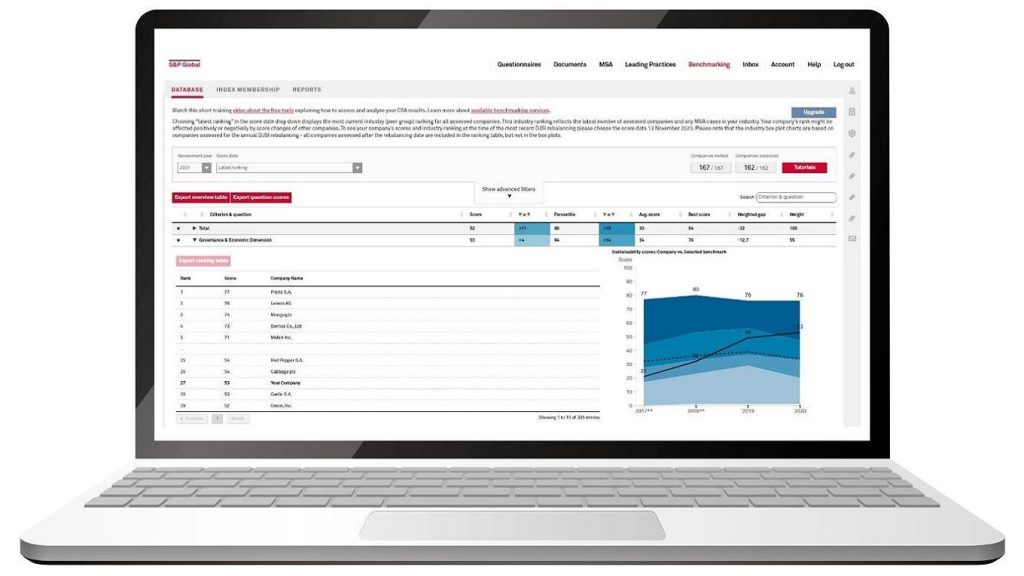

S&P Global Corporate Sustainability Assessment (CSA)

The S&P Global Corporate Sustainability Assessment (CSA) is an annual evaluation of companies’ sustainability practices that covers thousands of companies from around the world. Companies are invited to participate (and thus receive a CSA Score) based on their inclusion in the Dow Jones Sustainability Indices, the S&P ESG indices, or several other sustainability indices.

A company receives an ESG score by completing one of 61 industry-specific questionnaires, submissions which then undergo multiple layers of quality checks, expert reviews, and peer comparison. As long as it is willing to share its resulting score on the S&P Global platform, any company will be assessed free of charge. The CSA scoring is used by companies to communicate with investors and benchmark sustainability performance relative to industry peers.

Sustainalytics

Sustainalytics, a Morningstar Company, provides environmental, social, and governance (ESG) research, ratings, and data to institutional investors and companies. The Sustainalytics ESG Risk Ratings evaluate the degree to which a company’s enterprise value is exposed to material ESG issues.

Specifically, they measure a company’s exposure to industry-specific material ESG risks, and how well that company is managing those risks. Combining the concepts of management and exposure, they arrive at an absolute assessment of ESG risk that is comparable across sub-industries, sectors, companies, and regions.

Vigeo Eiris

Vigeo Eiris provides environmental, social, and governance (ESG) research, ratings, and data to institutional investors and companies. Since 2019, it has operated as a business unit of Moody’s Corporation. As part of the ESG Assessment, Vigeo Eiris analyzes companies’ ESG performance, identifies risks and opportunities, and screens controversies to develop ESG and Sustainability Ratings as well as Carbon Footprints of companies.

United Nations Global Compact (UNGC)

The United Nations Global Compact (UNGC) is a voluntary initiative based on C-level commitment to implement sustainability principles and take steps to support the UN Sustainable Development Goals. The UNGC provides a policy framework for organizing and developing corporate sustainability strategies—based on universal principles—to encourage companies to explore innovative initiatives and partnerships with civil society, governments, and other stakeholders.

As a participant, an organization is expected to align with the Ten Principles of the UNGC and incorporate them into its business strategy. They’re also expected to communicate with their stakeholders on an annual basis about the implementation of the Ten Principles and efforts taken to support societal priorities.

ESG reporting—simplified

From the GRI to the S&P Global, ESG management software is designed to help companies simplify and streamline the reporting process.

Novisto’s all-in-one platform enables you to seamlessly align your data with major ESG reporting frameworks, standards, and regulations. Monitor your progress, benchmark your performance, and drive your corporate sustainability journey for the long term.

Request your free demo of Novisto today.