What is ESG in business? Why is ESG essential in today’s sustainability landscape? And, which stakeholders care most—and why?

This post is the first of a two-part blog series where we’ll unpack these questions. To get started, we’ll provide an introductory overview of this elusive three-letter acronym (and why it’s more topical than ever).

The time is now

We're globally awakening to the need to better manage sustainability-related issues. Societal challenges such as climate change, biodiversity loss, and widespread income inequality are grave and distressing, constituting both interconnected system-level risks and system-level crises.

And they aren’t dissipating.

Companies have an important role to play here: they can contribute by gaining clarity on the environmental, social, and governance (ESG) issues that are relevant to their operations. They can also examine their impact materiality, which involves ascertaining how their business activities affect the ecosystems in which they’re embedded. Part of this entails identifying material risks and opportunities, measuring and tracking ESG performance, setting targets, rallying internal stakeholders, and identifying areas for improvement. In so doing, companies can unlock new value, for themselves, for their stakeholders, and for the planet.

What is ESG in business?

ESG designates environmental (E), social (S), and governance (G) issues, often used in reference to sustainability considerations. The ESG acronym has become especially popular in the investment and finance space, signifying a broader range of issues requiring due diligence and analysis to make informed, risk-adjusted investment decisions.

ESG issues are essentially business issues, categorized as environmental, social, or governance in nature. They are sustainability-related considerations on par with traditional financial factors like economic contributions and financial returns.

It’s important to understand that not all ESG issues matter or are material to all companies—these depend on the exact nature of a company’s business activities, where it’s located, and where its value chain operates. In other words: what a company does, how it does it, and where it does it.

Thus, the objective is to prioritize the ESG issues that are most relevant to your company and its core activities.

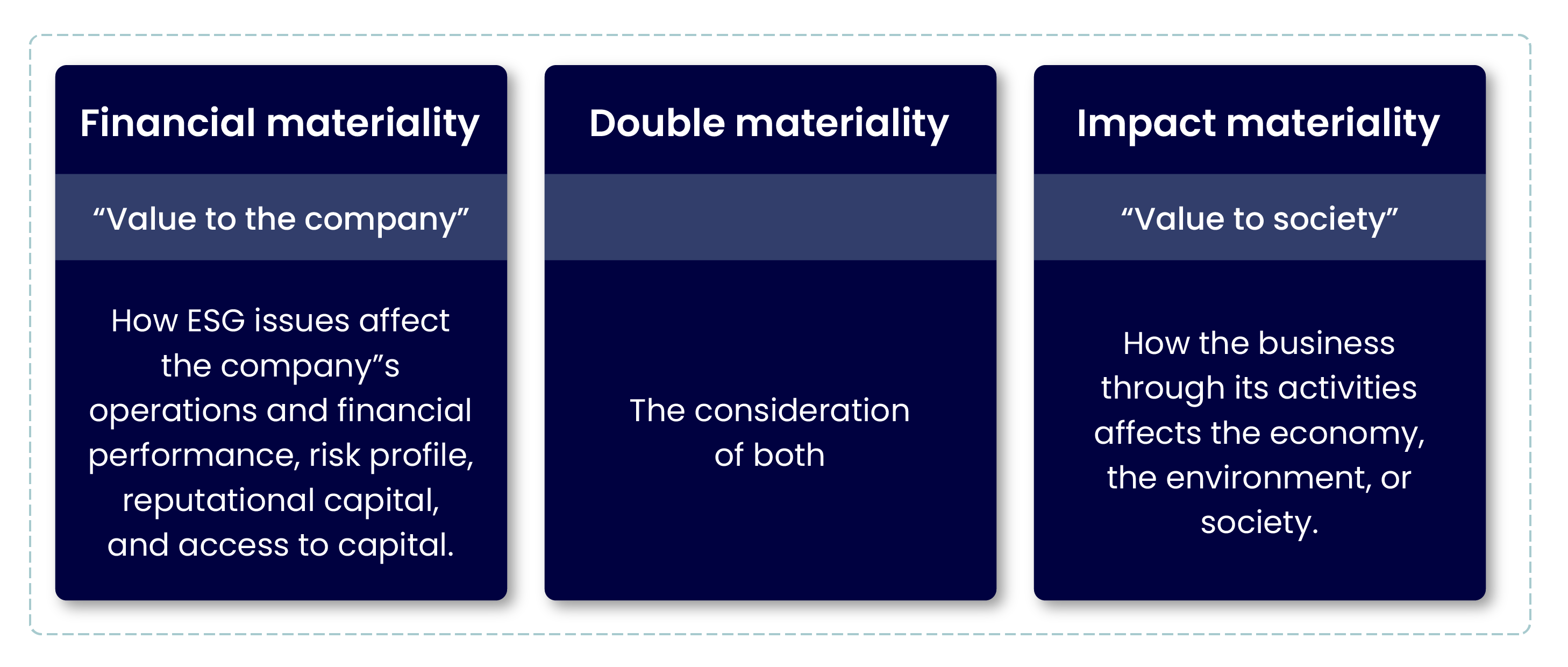

Defining materiality

The general definition of materiality is the quality of being relevant or significant to the form or identity of something. In the context of regulatory disclosure obligations, information is material if it influences the price of a security, or if prudent investors would seek this information before investing. In the realm of corporate sustainability and ESG, the concept of materiality has evolved to encompass issues that significantly impact a company's ability to create, preserve, or erode value over the short, medium, and long term. These issues can be of an economic, environmental, social, or governance nature.

From ESG to sustainability

Although “ESG” and “sustainability” are often used interchangeably, they embody distinct nuances in perspective and intention.

ESG issues include sustainability-related business concerns that directly impact a company's performance, risk profile, and access to capital.

In contrast, sustainability represents a broader mindset, guiding how a company conducts its business. Furthermore, sustainability considerations underscore the interdependency between the company and its ecosystem or ‘operational sphere of influence'.

The main distinction between ESG and sustainability lies in one’s perspective. On the one hand, ESG focuses on micro-level issues. This includes managing particular ESG issues and how they impact the company's performance, risk, and long-term prospects, with outputs and outcomes as measured ESG metrics. On the other hand, sustainability looks at the macro level, encompassing the management of a company's activities and their overall impact on the environment and society. This impact is measured using performance indicators.

In the realm of corporate sustainability reporting, the differentiation between micro and macro perspectives is commonly illustrated through the dimensions of materiality (see Figure 1 below). Specifically, this distinction is evident in the separation of financial materiality from impact materiality. While financial materiality pertains to how ESG issues affect the company’s operations, financial performance, risk profile, etc., impact materiality reflects the company’s external impacts (both positive and negative) on people, the planet, and society. Moreover, double materiality entails a consideration of both financial materiality and impact materiality.

Figure 1. Dimensions of Materiality

Ultimately, the decision to prioritize ESG issues or sustainability is a matter of intention: focusing on corporate results or environmental and social impacts. Both approaches can create value, and ideally, companies should aim to achieve the two.

ESG issues in business (in a nutshell)

Broadly, ESG refers to three interconnected pillars that can guide responsible and ethical business practices and help companies identify their financial materiality profile. When considering what ESG is in business, it’s important to understand what each ‘pillar’ represents:

- Environmental factors (E): From the perspective of impact materiality, the environmental dimension of ESG is about how a company affects the natural world. It includes concerns like resource usage, waste handling, carbon emissions, and efforts to combat climate change. Regarding financial materiality, companies need to identify which environmental risks impact the conduct of their business. By embracing sustainable approaches, companies can mitigate their ecological impacts in the transition to a net-zero future.

- Social factors (S): From the perspective of impact materiality, the social aspect of ESG pertains to a company's influence on society. It encompasses considerations related to employees, communities, customers, and other stakeholders. This facet centers on essential factors such as fair labor practices, employee well-being, human rights, community engagement, etc. By prioritizing social responsibility, companies can build strong, positive relationships and make meaningful contributions to the overall welfare of society. With respect to financial materiality, companies will want to pinpoint which social issues are most relevant to them. This involves ascertaining how/to what degree social issues affect their risk profile, reputational capital, investor attractiveness, etc.

- Governance Factors (G): When it comes to what ESG is in business, robust governance means that companies conduct themselves with honesty and transparency, proficiently handle risks, and prioritize the welfare of all stakeholders when making decisions. More specifically, governance pertains to corporate leadership, executive pay, and board composition, to name a few. According to the World Economic Forum, governance is foundational, as it supports the realization of environmental and social performance on the whole.

Want to learn more about the three pillars and their importance for understanding what ESG is in business? We’ll provide a more detailed overview shortly.

The relevance of ESG practices in business—who cares and why?

A company’s ESG performance is critical for multiple stakeholders, for diverse reasons. Increasingly, a range of players—from investors to employees—are requiring companies to demonstrate transparency in how and to what degree they’re impacting the ecosystems in which they’re embedded. Getting a firm grip on what ESG is in business is fundamental to this process.

From a company’s perspective, ESG issues matter because operational and financial performance is affected by how well the company manages them (think revenues, operational costs, expenses, R&D investments, etc.). Indeed, the proper management of ESG business risks and opportunities influences long-term financial prospects, resilience, and reputational capital. It also informs the decisions key stakeholders make—decisions that can have direct, and profound—consequences on company performance.

Your investors care

In an era of heightened financial turbulence, ESG performance is increasingly being tied to financial benefits—and penalties. Therefore, sound ESG performance (reflected in a positive appraisal from a ratings agency, for example), can create tangible financial benefits such as improved access to investments and lower-interest loans. If investors perceive poor—or worse, nonexistent—management and oversight of material ESG issues, companies will increasingly see shareholder engagement on these issues through active dialogue, proxy voting, resolution filings, or in some cases, divestment.

Your customers care

The dawn of “conscious consumerism” means that consumers are increasingly paying attention to the sustainability impacts of the brands they purchase from. Presently, a growing body of consumers actively seek out companies recognized for their “ecological friendliness”, willingly choosing to support them. As highlighted by Dr. Andreas von der Gathen, co-CEO of Simon-Kucher, sustainability ranks among the top five value drivers for 50% of consumers.

From nice to necessity

Ultimately, the identification and management of environmental, social, and governance issues are no longer “nice-to-haves”—they’re imperative. It’s therefore in a company’s best interest to identify and manage its material ESG issues because doing so creates value for itself and its stakeholders. For example, enhanced ESG performance can result in a more favorable image and, consequently, heightened brand loyalty.

In the sections that follow, we’ll take a closer look at what ESG is in business through an exploration of each ESG pillar. We’ll also examine their importance in promoting responsible business practices. Please note that we’ll approach this exploration from a more "macro-level" sustainability perspective.

Environmental factors in business—promoting a cleaner planet

When unpacking what ESG is in business, it’s key to understand the "E". This is especially relevant amidst heightened stakeholder scrutiny, compelling businesses to reduce their ecological footprint and embrace sustainability. Let's take a closer look at the “E” in ESG, delving into how companies can assess and elevate their sustainability initiatives.

Understanding the “E” in ESG

The "E" in ESG represents environmental factors, encompassing various concerns regarding a company's influence on the natural world. Key areas of focus include:

- Resource consumption: According to the European Commission, the growing demand for water, food, energy, land, and minerals is leading to a significant rise in scarcity and higher costs of natural resources. Companies have an important role to play here. By adopting efficient practices, businesses can reduce waste, safeguard valuable resources, and lessen their overall impact on the environment.

- Waste management: Effectively managing waste is critical for companies to minimize pollution and ecological damage. This involves implementing proper waste disposal systems, promoting recycling initiatives, and embracing circular economy principles to decrease waste generation and optimize resource utilization.

- Carbon emissions and climate change mitigation:Confronting the global challenge of climate change necessitates significant action from companies. Indeed, they have a vital role in reducing carbon emissions by adopting renewable energy sources, enhancing energy efficiency, and implementing carbon offset strategies.

Sustainable resource management

Incorporating sustainable resource management is vital for forward-thinking businesses. Through the adoption of sustainable practices, companies can optimize resource utilization and reduce adverse environmental effects. Here are several strategies to achieve effective resource management:

- Energy efficiency: Enhancing energy efficiency not only results in reduced greenhouse gas emissions but also generates cost savings. Companies can conduct energy audits, invest in energy-efficient technologies, and promote energy-saving practices among employees.

- Water conservation: To address growing water scarcity concerns, businesses can adopt water conservation measures like reducing water usage, implementing water recycling initiatives, and utilizing efficient irrigation systems.

- Responsible waste management:The adoption of responsible waste management practices is paramount to minimizing pollution and waste generation. This encompasses establishing recycling programs, practicing waste segregation, composting organic materials, and forming partnerships with recycling or waste management organizations.

- Supply chain sustainability: Extending sustainability efforts to supply chains is essential. Companies can assess suppliers’ environmental practices, advocate for sustainable sourcing, and collaborate with suppliers to drive positive environmental changes.

Climate change mitigation strategies

Climate change stands as one of the most pressing environmental crises affecting our planet. Businesses hold a crucial role in reducing greenhouse gas emissions and adapting to the changing climate. Here are several strategies for mitigating climate change:

- Adoption of renewable energy: Embracing renewable energy sources like solar, wind, or geothermal power can significantly diminish a company's carbon footprint. By investing in renewable energy infrastructure or obtaining renewable energy credits, businesses actively contribute to the expansion of the clean energy sector.

- Energy-efficient operations: Enhancing energy efficiency across operations is a pivotal approach to combat climate change. This involves upgrading equipment, optimizing heating, ventilation, and air conditioning (HVAC) systems, and implementing smart energy management systems. Increasingly, companies are investing in carbon accounting solutions to track and improve their performance.

- Carbon offsetting: Companies can offset their carbon emissions by supporting projects that reduce or eliminate greenhouse gases from the atmosphere. This may include investing in reforestation initiatives, renewable energy projects, or carbon capture and storage programs.

Social factors in business—people matter

The “S” in ESG represents social business issues, including the impacts a company has on people and society. Given that consumers are increasingly choosing products and services that align with their values—and their conscience—adhering to fair and ethical labor practices and human rights has become imperative to sustaining a healthy bottom line. Let's delve into the importance of social factors and examine how companies can cultivate more responsible business practices.

Understanding the “S” in ESG

Social factors encompass a wide range of considerations related to a company's interactions with employees, customers, and the communities in which they are embedded. And, how companies interact with their ecosystem—including the negative and positive impacts on human resources—is increasingly being scrutinized. Indeed, given the growing influence of values-driven millennial and Gen Z employees, businesses are under mounting pressure to improve their social performance to attract and retain human capital.

Social issues encompass the following key areas:

- Ethical labor practices: Establishing fair labor practices entails ensuring safe working conditions, offering equitable wages, maintaining reasonable working hours, and upholding workers’ rights. This commitment extends to providing opportunities for professional development, training, and fostering a healthy work-life balance.

- Diversity, equity, and inclusion (DEI): Implementing DEI within the workplace is essential for creating a fair and equitable environment where individual differences are valued. Businesses that prioritize DEI will take active strides to ensure that equal job opportunities are readily available to all. Part and parcel of workplace DEI involves embracing diversity in all of its forms, including gender, race, ethnicity, age, and neurodiversity, while fostering an inclusive culture that values, respects and supports workers in their individuality.

- Community engagement and philanthropy: Engaging with local communities and giving back is an integral part of responsible business practices. To foster positive impacts, companies can establish partnerships with local organizations, addressing community needs through collaborations, volunteer programs, or skill-sharing opportunities. Developing social impact programs further enables companies to tackle specific community challenges, ranging from environmental conservation to healthcare, as well as support for underserved populations.

Let’s unpack some of these social factors now and why they’re important in business.

Ethical labor practices

Promoting the well-being and fair treatment of employees by adhering to ethical labor practices is crucial for companies. Here are some considerations for fostering ethical labor practices:

- Employee health and safety: Prioritizing the health and safety of employees involves creating secure working environments, conducting routine safety audits, and implementing strong health and safety protocols. Measures such as supplying suitable personal protective equipment (PPE), offering safety training to employees, and formulating emergency response plans are essential components of this commitment.

- Labor rights and fair wages: Upholding labor rights and guaranteeing equitable wages are fundamental elements of ethical labor practices. This entails adhering to labor laws and regulations, treating employees with dignity and respect, and offering fair compensation that aligns with industry standards and the cost of living.

- Work-life balance: Promoting work-life balance is crucial for supporting employee well-being and reducing both presenteeism and absenteeism. To this end, companies can implement policies such as flexible work arrangements and wellness programs.

Diversity, inclusion, and equal opportunities

Embracing diversity and fostering an inclusive work environment is imperative for talent acquisition and retention. An analysis of Gen Z employees by John Hopkins University reveals that this generational cohort, more than any of its predecessors, is prioritizing DEI. And their commitment extends beyond racial and ethnic considerations: they also prioritize the freedom to express one’s gender identity, with 88% believing that employees should inquire about preferred gender pronouns.

Additionally, growing momentum surrounding the neurodiversity movement has led to considerable changes in workplace hiring and retention practices. The World Economic Forum states that “some of the world’s biggest companies are now actively looking to hire neurodiverse workers and provide appropriate support once they gain employment,” a trend that is likely to solidify with time.

In light of these realities, companies need to consider the following factors for promoting diversity, inclusion, and equal opportunities:

- Diverse hiring practices: Companies are increasingly implementing inclusive hiring practices to actively seek diverse talent. This can include reviewing job descriptions, examining biases, implementing novel candidate sourcing strategies, and establishing partnerships with organizations focused on underrepresented groups.

- Inclusive work culture: Fostering an inclusive work culture involves creating an environment where everyone feels valued and respected. This includes promoting open dialogue, providing diversity and inclusion training, and actively addressing unconscious biases. Not only is this the “right” thing to do, but it also makes business sense. According to Deloitte, fostering an inclusive culture is vital to talent strategies and can lead to enhanced creativity, productivity, and innovation. Indeed, their survey of over 1,300 full-time employees across the United States uncovered that 80% of employees now consider inclusivity when choosing an employer.

- Equal growth opportunities: With 68% of workers tying upskilling opportunities to sustained employer loyalty (staying with their employer throughout their career), continuous development opportunities are more topical than ever. This is especially being prioritized amidst the growing AI revolution and fears of skill obsolescence. Companies can mitigate these anxieties by providing equal opportunities for career growth and continuous learning and upskilling: this can encompass mentorship programs, leadership training, and initiatives aimed at supporting employee development.

Governance factors: building strong business foundations

The “G” in ESG stands for governance factors, which encompass a company's internal policies, practices, and structure for guiding decision-making processes. Strong corporate governance is vital for fostering trust, transparency, and responsible decisions that benefit all stakeholders. Let's examine the importance of governance factors in ESG and explore how companies can establish robust corporate governance practices.

Understanding the “G” in ESG

Governance factors pertain to how companies are guided, managed, and overseen. Key areas of emphasis include:

- Transparency and accountability: Transparency plays a critical role in establishing trust and credibility with stakeholders. It involves the production and timely disclosure of both financial and non-financial information, ensuring stakeholders have access to accurate, high-quality data on a company’s material ESG issues. Moreover, accountability entails holding individuals and the organization accountable for their specific actions and outcomes.

- Board composition and independence: The make-up of the board of directors holds significance in ensuring efficient governance—including oversight of ESG issues—and business success. As indicated by the Harvard Law School Forum on Corporate Governance, “Companies need boards with directors who have a diversity of backgrounds, as well as the skills and experience to oversee the expanding list of priorities”. Moreover, independent directors can offer impartial oversight and question management decisions when required.

- Executive compensation and incentives: Designing suitable executive compensation packages is a crucial aspect of sound governance. Companies can tie executive compensation to ESG performance and long-term value creation, connecting it with key performance indicators and sustainable business practices. This alignment ensures that executives are motivated to make decisions that positively impact the organization and its stakeholders.

- Shareholder rights and engagement: Successful governance relies on upholding shareholder rights and fostering engagement. Treating all shareholders fairly, providing channels for their views, and facilitating open dialogue is crucial. Companies can enhance engagement through proxy voting, shareholder resolutions, and conducting informative AGMs. Effective communication channels, like regular updates and newsletters, build trust and strengthen the company-shareholder partnership.

Let’s take a closer look at the first two elements listed above, namely: 1) transparency and accountability, and 2) board composition and independence.

Transparency and accountability

Transparency and accountability are fundamental principles of effective governance. Here are approaches to foster transparency and accountability within organizations:

- Robust reporting and disclosures: Increasingly, companies need to produce detailed and timely reports encompassing financial and non-financial information, including ESG risks and opportunities. This includes financial statements, sustainability reports, and other relevant disclosures, providing stakeholders with a clear understanding of the company's performance and impact. When it comes to providing transparency on ESG performance, companies are increasingly turning to ESG reporting software to get the job done with greater ease and efficiency.

- Ethical conduct and anti-corruption measures: Establishing a code of ethics that guides employees’ behavior and promotes ethical conduct is a key aspect of sound governance. For example, implementing anti-corruption measures and internal controls helps prevent fraud, bribery, and other unethical practices.

- Stakeholder engagement: Actively involving stakeholders is essential for transparent governance. Companies should seek input from various groups, such as employees, customers, suppliers, and communities, to understand their perspectives, needs, and concerns. In the context of environmental, social, and governance oversight, ESG data management and reporting software facilitate transparent communication with diverse stakeholders, enabling organizations to provide timely and comprehensive business-relevant ESG information. In turn, this fosters trust and builds stronger relationships.

Board composition and independence

Effective governance hinges on the assurance of a well-structured and independent board. Considerations for achieving an effective board composition include:

- Diversity and inclusion: Prioritizing diversity and inclusion in board selection involves considering gender, race, age, and ethnicity. Members from diverse professional and educational backgrounds are important here. A wide array of perspectives is always good for business and can make it more likely that open and honest conversations surrounding transformative issues will be had. Diverse boards are also likely to make more informed decisions and drive innovation. MIT’s “CARE Model” offers an interesting perspective on how diversity can enhance board effectiveness. For example, the “C” challenges companies to examine whether their boards reflect the diversity of their stakeholders and are supportive of corporate strategy and overarching business trends.

- Independence: Director independence plays a vital role in effective corporate governance, ensuring objective judgment that represents the interests of all shareholders. Independence assessment involves considering relationships that may affect a director's impartiality, including ties with the company, senior management, or other directors.

- Board evaluation: Conducting board evaluations entails examining the effectiveness and performance of a company’s board of directors. These evaluations help identify areas for improvement, assess the board’s relationship with executive leaders, and ensure significant value-added to the organization. Board evaluations are generally conducted in phases and can include the use of surveys, interviews, presentations, and meetings between the chair and CEO.

ESG in business—into the future

To meet the rising demand from investors and other stakeholders for reliable and auditable ESG information, companies are starting to digitize their sustainability data collection and reporting practices. A growing number are turning to ESG data management software to get the job done, helping them effectively collect, manage, and use their ESG data to drive change.

By employing effective data management practices and having reliable, centralized ESG data, your company will gain a better understanding of its sustainability performance, making it easier to share progress and take appropriate action.

Novisto is here to help you evolve your sustainability story—for the long term. Let’s get started.

Book your free demo today.

*Explore Part 2, where we further unpack the relevance of ESG in business and explore challenges and best practices in ESG implementation.