While the terms “ESG” and “sustainability” are often used interchangeably, they are not quite the same thing. Variations in perspective and intention help explain the difference.

What do we know about ESG in companies?

ESG is an umbrella term that refers to environmental (E), social (S), and governance (G) issues. While these are to be understood as business conduct-related issues, the ones that matter to a company will differ depending on the exact nature of its business activities, where it is located, and where it operates.

Issues identified as material matter because:

- Stakeholders care about them and make decisions based on how the company manages them—decisions that directly affect the company;

- Operating and financial performance are affected by how the company manages them;

- Society and the environment are affected by how the company manages them.

While ESG and sustainability are inextricably linked, they are not one and the same.

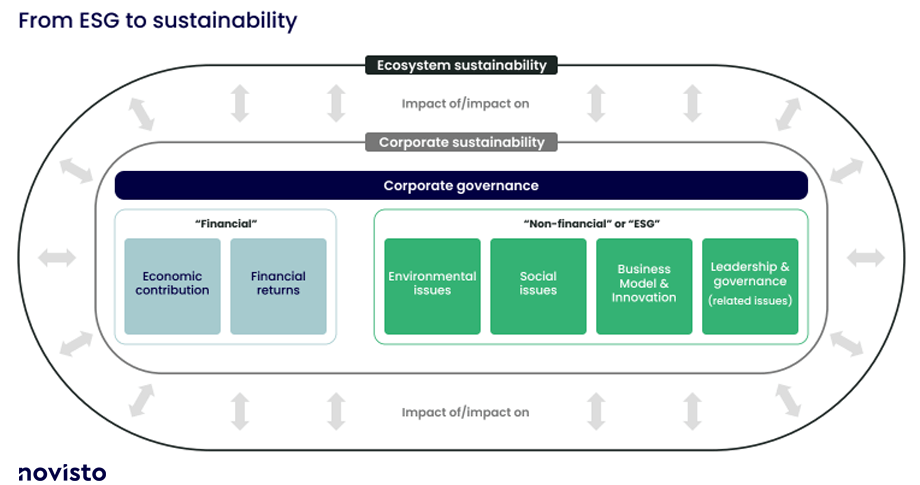

ESG issues in business are indeed sustainability-related considerations that sit side by side with traditional financial considerations such as economic contribution and financial returns. The Sustainability Accounting Standards Board (SASB) identifies five categories of ESG issues: business model and innovation, environment, human capital, social capital, leadership, and governance. Topics related to governance can be further differentiated as those pertaining to the structure of the governing body, such as board composition, independence, and expertise (aka traditional corporate governance), and those that fall within the purview of the governing body, such as climate change or responsible taxes.

Sustainability, on the other hand, is more of a mindset in the way to conduct business. It concerns the interdependency between a company and the ecosystem it operates in (see Figure 1).

Figure 1

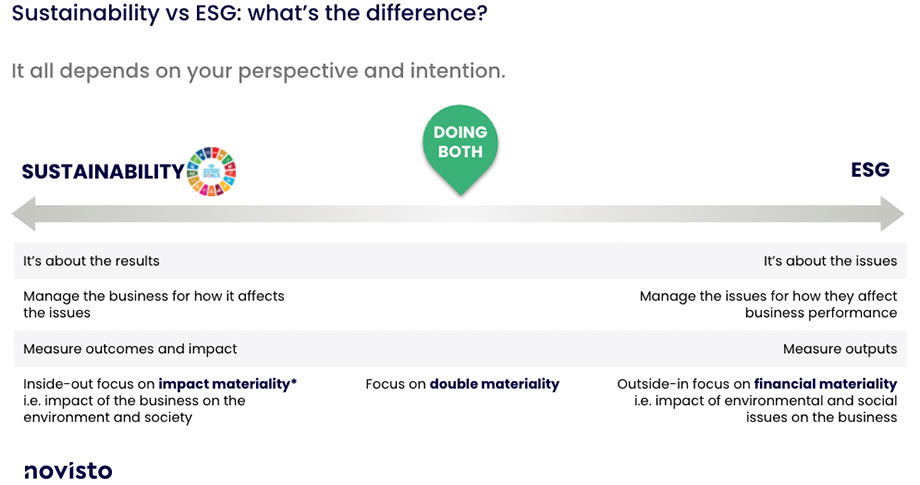

One of the main distinctions between ESG and sustainability is perspective, or the level at which you are thinking about these issues. A company’s focus on ESG issues at the micro level involves managing these issues for how they affect its operating and financial performance, risk profile, access to capital, and long-term prospects. At this level, a company measures its outputs and outcomes.

A company’s focus on sustainability at the macro level involves managing how its business activities affect the environment and society more broadly. In doing so, it may leverage the framework offered by the 17 UN Sustainable Development Goals (SDGs), adopted unanimously by all members of the United Nations in 2015. They have been called “the closest thing the world has to a sustainability strategy.” Very simply, they aim to end poverty, protect the planet, and ensure peace and prosperity around the globe by 2030, and to “leave no one behind”. Somewhat less simply, the 17 goals break down into 169 targets and 232 performance indicators. At this macro level, such performance indicators measure impact.

In corporate sustainability reporting, this distinction between the micro and macro perspectives is often expressed in the dimensions of materiality. As the International Integrated Reporting Council says, a material issue is one that substantially affects the company’s ability to create, preserve, or erode value over the short, medium, and long term. What’s included in the measurement of value can vary. For its part, the Global Reporting Initiative (GRI) explains that when referring to the measure of economic value creation at the company level we speak of financial materiality, and when referring to the measure of a company’s impact on the economy, the environment, and society, we speak of impact materiality. Companies that do both at the same time embrace the concept ofdouble materiality (see Figure 2).

Figure 2

Furthermore, choosing whether to focus attention and resources on ESG issues more narrowly or on sustainability more broadly is not only a question of perspective, it’s also very much a question of intention: corporate results or environmental and social impacts. Neither one is intrinsically ‘bad’ or ‘good’. Both have merits and can be value-creating. Ideally, companies should seek to achieve both. In this respect, adopting a double materiality approach to identifying, managing, and measuring a company’s sustainability-related issues certainly makes sense.

Corporate purpose is the binding agent.

The concept that ties both ESG and sustainability together is corporate purpose - defined by the British Academy as a way to “profitably solve the problems of people and planet, and not profit from causing problems.” It not only captures both the levels of perspective and of intention described above but interconnects them.

As we experience the paradigm shift to a sustainability mindset and as governments, investors, employees, and citizens increasingly take sustainability into consideration when making decisions, we expect that corporate success and competitive advantage will increasingly be predicated on the combined achievement of profitability and sustainability. Organizations across all industries will indeed be pressured to achieve both. For companies, this means an expanded set of performance measures to include negative and positive environmental and social impacts, and an expanded scope of corporate disclosures.