Since addressing our most pressing societal and environmental issues requires an all-hands-on-deck approach, having a common understanding of the words we use to communicate and collaborate becomes paramount — not to mention the acronyms that seem to proliferate in sustainability faster than we can memorize them. Some even look and sound alike! However, that doesn’t mean they refer to the same thing.

Take for example, ‘GHG’ and ‘ESG’.

Other than being three-letter acronyms that end with a G and that are best used as adjectives rather than nouns, they have less in common than you might think.

GHG

GHG is an acronym for greenhouse gases. Greenhouse gases are natural and human-produced gases in the Earth’s atmosphere that absorb and re-emit infrared radiation, trapping heat. This is known as the “greenhouse effect” that results in global warming.

Carbon dioxide is the biggest contributor to global warming due to its relative abundance and the length of time it stays in the atmosphere. So much so that GHG is frequently, mistakenly conflated with carbon (think carbon-intensive or carbon accounting).

In fact, other greenhouse gases trap relatively more heat in the atmosphere than carbon dioxide. For example, methane is 28 times more potent than carbon dioxide at trapping heat in the atmosphere and has a significant impact on near term warming. Nitrous oxide is 273 times more potent. Different economic activities are responsible for the release of different greenhouse gases.

The Kyoto Protocol defines seven GHGs: carbon dioxide (CO2), methane (CH4), nitrous oxide (N2O), as well as four fluorinated gases - synthetic gases that are emitted from a variety of household, commercial, and industrial applications and processes.

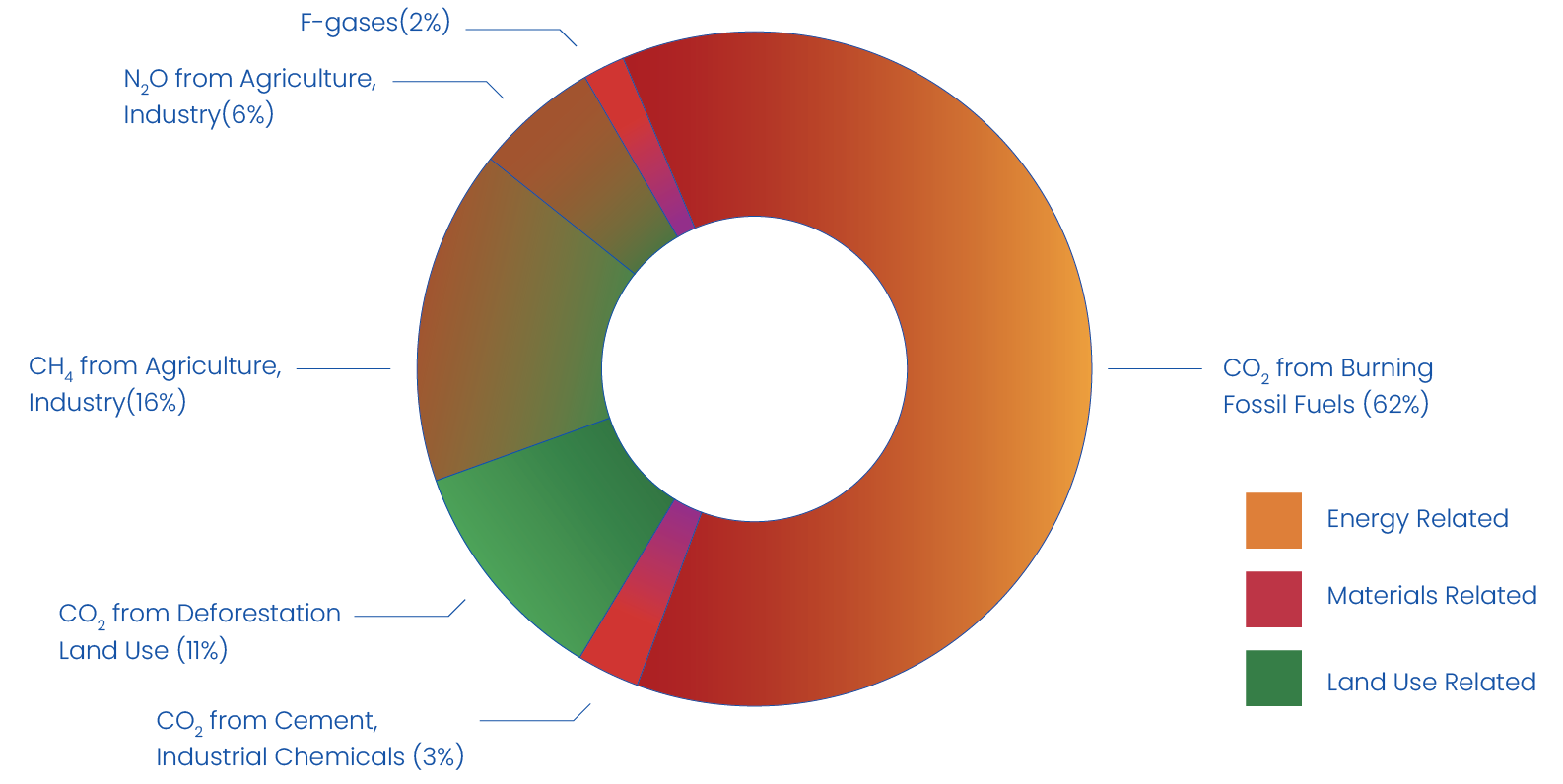

Sources of Global Greenhouse Gas Emissions1

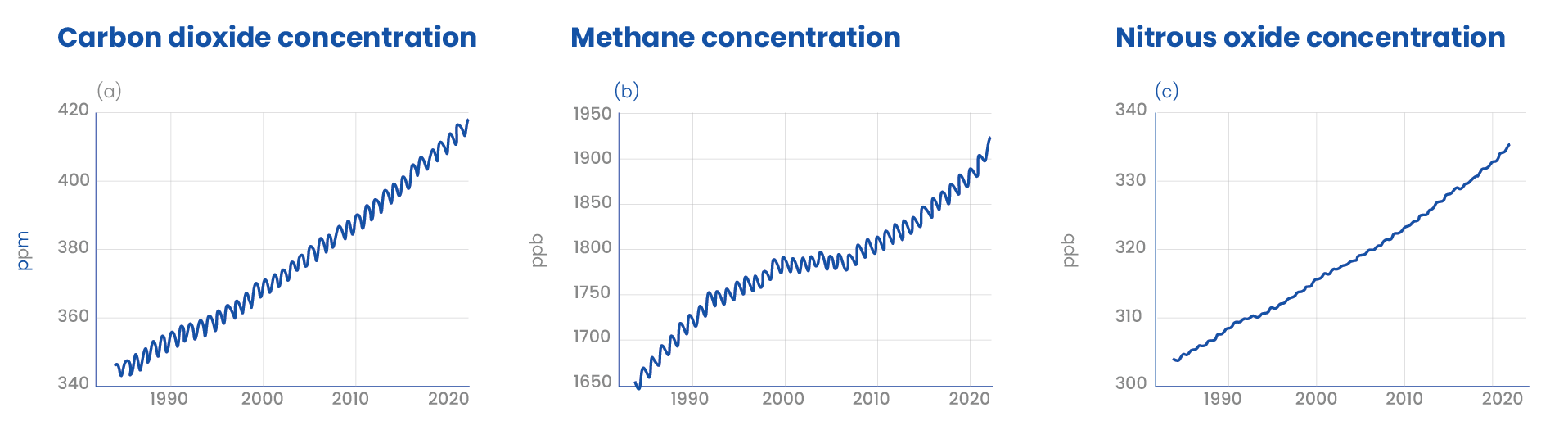

The amount (or level) of greenhouse gases in the atmosphere can be measured. According to the World Meteorological Organization, the amount of carbon dioxide in the atmosphere reached a record high of 415.7 parts per million in 2021. Methane and nitrous oxide levels are also at all-time highs.

Concentrations of carbon dioxide, methane and nitrous oxide in the Earth’s atmosphere

Note: Mind the scale! Carbon dioxide is measured in parts per million, not parts per billion

Note: Mind the scale! Carbon dioxide is measured in parts per million, not parts per billionIn a corporate context, GHG typically refers to the emission of greenhouse gases by companies. Companies calculate or estimate their GHG emissions by following guidance in the GHG Protocol or the ISO 1406x standards. Emissions are typically expressed in tonnes of carbon dioxide equivalent (tCO2e) — a measure of how much a greenhouse gas contributes to global warming relative to carbon dioxide.

GHG emissions have become a key performance measure to assess corporate action on climate change. Corporate GHG emissions provide information on a company’s:

- Impact on climate change: a quantification of the greenhouse gases that the company has emitted into the atmosphere over a defined period of time;

- Exposure to climate risks: an (imperfect) proxy for the company’s exposure to the legal, regulatory, and technological risks associated with global efforts to transition to a “low carbon” economy.

With the world’s attention now sharply focused on addressing the worst effects of climate change, companies are yielding to the pressure to measure their emissions and take action to reduce them, leading many of them to set emissions reduction targets.

However, GHG emissions provide only a very broad brush perspective on the complex interlinkages and interrelationships driving climate change. For example, a company’s emissions footprint tells us very little about its exposure to physical risks from acute and chronic weather changes, or about how it addresses its dependencies and impacts on a host of other sustainability-related issues.

ESG

ESG is an acronym that refers to environmental (E), social (S), and governance (G) issues. There are many, very different issues that fall under this umbrella term, and a company’s GHG footprint is just one aspect of a business-related environmental issue.

Examples of business-related topics that fall under the different categories of ESG issues

Examples of business-related topics that fall under the different categories of ESG issuesThe term ESG was coined by the team at the United Nations Environment Programme Finance Initiative in the October 2005 Freshfields Report. It was created as a tool to ‘speak the language of finance’, in order to bring mainstream asset owners to understand that addressing systemic social and environmental issues, with potentially systemic consequences, was in fact part of their fiduciary duty.

ESG issues are indeed sustainability-related considerations that sit side by side with traditional financial considerations such as economic contribution and financial returns. The Sustainability Accounting Standards Board (or SASB, now consolidated into the IFRS Foundation) identified five categories of ESG issues: business model and innovation, environment, human capital, social capital, and leadership and governance. Topics related to governance can be further differentiated as those pertaining to the structure of the governing body, such as board composition, independence, and expertise (aka traditional corporate governance) and those that fall within the purview of the governing body, such as climate change, cybersecurity, ethics and culture, or responsible taxes.

The term ESG is often used to refer to companies’ financially material business-related issues. But not all ESG issues are material to all companies. They will differ depending on the company’s industry, the exact nature of its business activities, and where it operates. They matter because:

- Stakeholders care about them and make decisions based on how the company manages them—decisions that directly affect the company;

- Operating and financial performance are affected by how the company manages them;

- Society and the environment are affected by how the company manages them.

While the terms ESG and sustainability are often used interchangeably, they refer to different things. Variations in perspective and intention help explain the difference. Perspective and intention also determine the lens through which the materiality principle is applied, and whether to focus on issues that affect the company’s operations and financial performance, risk profile, or reputational capital (so called “value to the company”), or to focus on how the company affects its natural and social ecosystems (so called “value to society”)—or both. In fact, the more we shift towards the latter inside-out perspective, the less we talk about ESG issues and the more we talk about impacts and dependencies.

Why it matters

Hopefully by now it has become clear that GHG and ESG are not the same. One acronym refers to a very specific performance measure in the context of the system-level issue of climate change. The other refers to a myriad of financially material sustainability-related issues in the context of business activities.

Confusing these two terms probably results from the fact that many companies—and individuals—come to sustainability through the gateway of climate change. And that’s OK. Everyone needs to start somewhere.

Of course, both are important to know and understand. Speaking the same language, using the terms that mean the same thing is the first critical step to gaining a common understanding of the issues we seek to address, and then being able to walk the talk.

1 Project Drawdown, Drawdown Roadmap, 2023

2 WMO, State of the Global Climate in 2022

3 WMO, State of the Global Climate in 2022